One important consideration when starting your business is determining the best legal structure of your business. Your selection of legal structure will affect operating efficiency, transferability, control, the way you report income, the taxes you pay, and your personal liability.

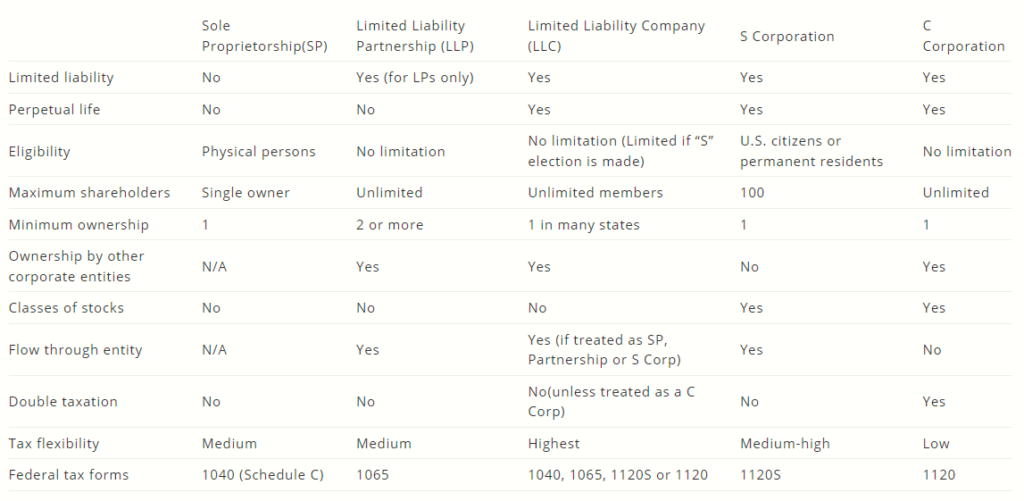

Here is the comparison of some of the basic considerations while selecting one of the five most common structures for your business entity:

The choice of a legal structure can be complicated and errors can be costly. In addition, current tax laws make it difficult to change your legal structure after you begin operating. Making the right decision before you open for business is very important.

Consult with a CPA who can help you decide what type of entity and structure is best for your situation and type of business, explain how business structure affects your organization’s bottom line, and file the necessary paperwork to start your business.

The choice of a legal structure can be complicated and errors can be costly. In addition, current tax laws make it difficult to change your legal structure after you begin operating. Making the right decision before you open for business is very important.

Consult with a CPA who can help you decide what type of entity and structure is best for your situation and type of business, explain how business structure affects your organization’s bottom line, and file the necessary paperwork to start your business.